Flagship Investments is proud to announce it has been awarded Top Performer in the Best Smaller Fund category by Investors Choice Awards 2020 in the APAC (Asia-Pacific) region. We are pleased to have been recognised for our consistent work and philosophy.

Read the Press Release here.

Click here to read more.

In the last six months, the phrase “new normal” has been used to describe the overhaul of every element of daily life. Since the world’s introduction to COVID-19 every activity that was part of our day to day life has been disrupted, cancelled or reimagined in the name of public health and safety. And as the financial year comes to a close we are left to think, is this our new way of life? Or, is there more to come?

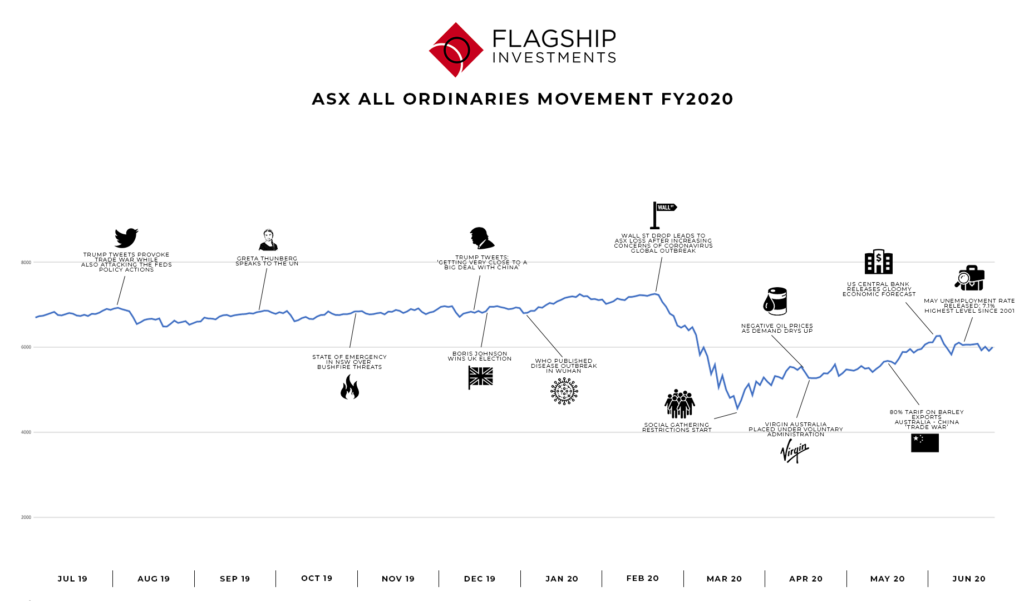

In terms of the financial markets, the impact of COVID-19 couldn’t be more dramatic. Every major index has shown some depression point as a result of the pandemic and the ASX All Ordinaries is no exception. As shown in the graph attached, the index in the first half of the year actually reflected the expected forecasts of moderate growth without upward pressure on inflation. In December 2019 there was excitement and relief about a potential result in the US-China Trade war and a Brexit date of 31 January 2020. In the first two months of 2020, the index climbed slowly higher until the Wall St drop on 21 February precipitated the crash in the ASX All Ords. It was the ongoing spread and impact of COVID-19 that had nations and markets worried, businesses were starting to flag the impact on earnings growth, it was clear that this was going to be a major event.

The Advantages of Unfranked Dividends

Governments around the world stepped up to determine the best course of action, medical and safety considerations were given utmost priority and a string of social distancing restrictions were put in place. Following these restrictions were financial stimulus packages, announced by the government to soften the impact on business viability and household incomes. So while schools, shopping centres and hospitality outlets shut down, the population trialled working from home and sanitising their hands every 15 minutes.

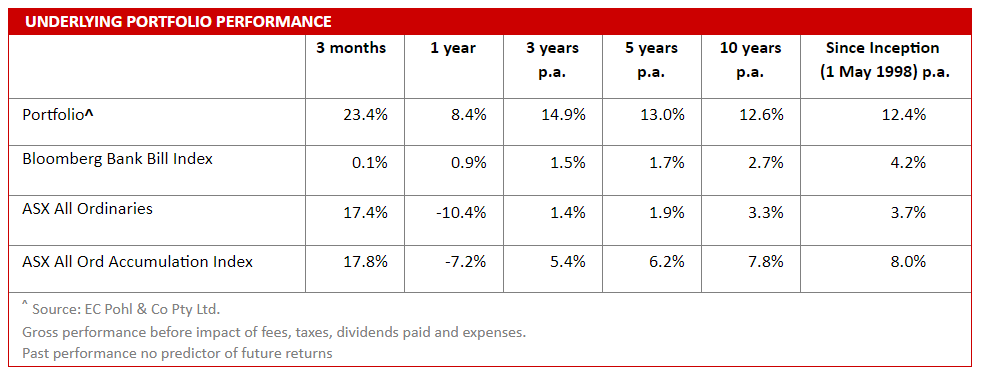

The market reaction to the distancing measures was dramatic, with the All Ords gaining 12.5% three days after the low point on 23 March 2020. And, slowly over the quarter as COVID-19 cases reduced the All Ords has increased to close at 6001.3, 31.5% above the March low and 10.4% decrease for the 2019/2020 year. The quarterly gains provided some reassurance to investors, however if investors were simply tracking the index then they will have suffered in the short term. At the end of this volatile period the Flagship Investments’ portfolio was up 31.8% and over the financial year has increased 8.4%. This is only a short term view though, so we consider the 5 year, 10 year and since inception performance as our preferred yard-stick.

There remains plenty of uncertainty around what’s to come and therefore we expect volatility will continue. On the positive side, the stimulus measures may have been enough to keep businesses afloat such that as restrictions are released consumption and earnings can rebuild and grow back to previous levels. On the negative side, the stimulus has been likened to a Kugel Fountain, a steady flow of money that is holding up businesses and markets, but, shut off the money and watch the ball plunge back to earth with significant consequences…

Time will tell which view is right, however like most periods in history, with time, things will improve. The priority of Flagship Investments remains focusing on the long term earnings potential of our investee businesses and remembering that even during times of turmoil a high quality, sustainable business with a competitive advantage will produce superior investment returns over the long term and in that sense, the “new normal” is the same as the “old normal”.

Flagship Investments Limited (FSI), ABN 99 080 135 913, is a unique ASX-listed invested company as the Manager is only remunerated on investment outperformance.