The financial year has drawn to a close, and it is remarkable to consider the current position against the outlook from 12 months ago. Thinking back to July 2020 we had witnessed an unprecedented market decline and hopeful recovery against the backdrop of a worldwide pandemic. The future prospects of the economy, at home and abroad, relied heavily on the development and rollout of vaccines and the ongoing coordinated stimulus from government and federal banks. Health officials were nervous, businesses were defensive, consumers were cautious, we braced ourselves for an unknown future.

Keep Calm and Continue On

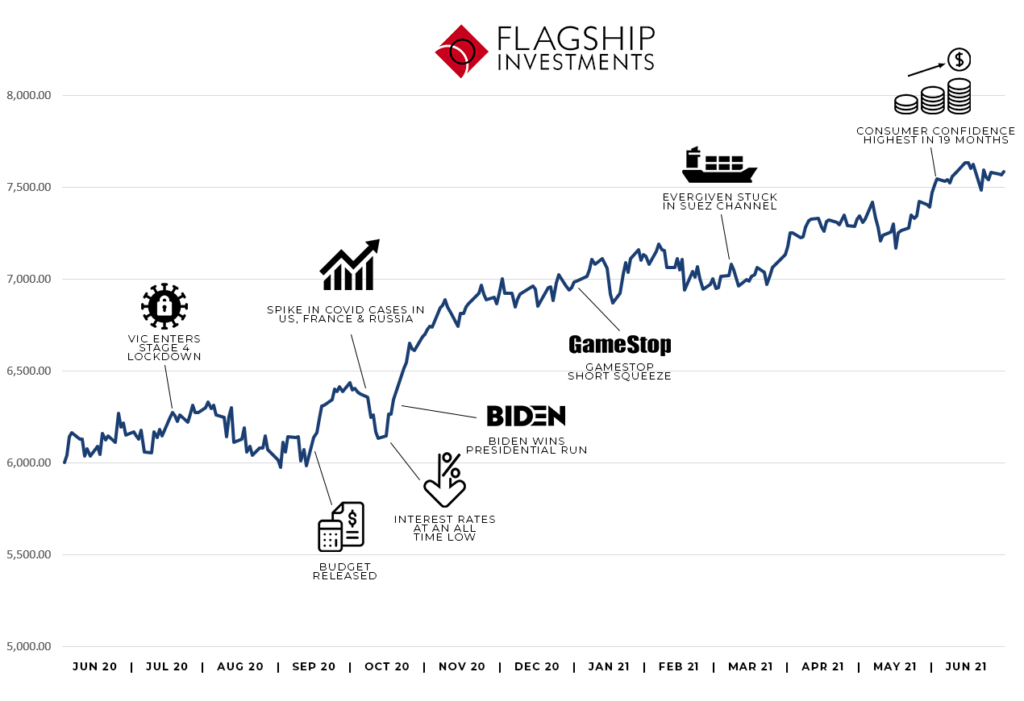

And what happened? The world kept turning, particularly in Australia, which lived up to its title of “The lucky country”. With comparably minor interruptions from intermittent lockdowns (my sympathies to the Victorians), the Australian business environment has been positive. Job keeper and job seeker packages have helped maintain employment and targeted stimulus in housing and infrastructure have assisted key areas of the economy. The delivery of the budget in October 2020 highlighted the government’s commitment to stimulate the economy and monetary policy remains favourable for spending and growth.

In the US we witnessed the end of the Trump administration. It was always going to be a dramatic affair, but I don’t think anyone expected the civil unrest that occurred. In spite of this the Dow Jones Industrial Index was up by 39% over the past twelve months Of particular interest was the activist nature of retail investors in the US against companies that had been targeted by short-sellers. In addition, during the last 18 months, the number of individuals getting involved in the financial markets has increased dramatically however the mob-like behaviours of the WallStreetBets crowd have been a truly unique phenomenon.

ASX All Ordinaries Movement FY 2021. Click to expand.

Throughout Europe, the control of COVID has been problematic with continued outbreaks occurring. Particularly in the first half of the financial year, the pandemic wreaked havoc on local economies while leaders of the EU and UK progressed with the Brexit deal. In the third quarter, like in much of the world, there was optimism surrounding vaccine progress and economic recovery with forecasts suggesting that the UK and Eurozone economies are on track to reach pre-pandemic levels by mid-2022.

In the Australian securities market, the ASX All Ordinaries increased by 26% over the financial year as vaccine-related news generated optimism, the Reserve Bank of Australia lowered the official interest rate to 0.1% and Biden won the US presidential election.

Twelve months ago, we forecast a substantial increase in the earnings for our portfolio companies which did occur and is in part the cause of our out-performance as compared to the market and of which we are incredibly pleased. This year’s annual performance of 40.7% adds to the since inception performance of 13.5% which is 9.0 percentage points higher than the ASX All Ordinaries over the same period of time.

Even though we are now coming off a much higher base, we expect the earnings of our portfolio companies to increase by approximately 12.5% per annum over the next five years. This provides some reassurance as we begin the new financial year where valuations (PE multiples) are stretched and which we expect are likely to contract by around 5.5% over the next five years from current levels. While it is almost certain that there will be further COVID outbreaks in the months ahead despite the vaccine program, the past year has shown how resourceful and resilient quality growth companies can be and this provides us with the confidence to face the new year and to make the most of the opportunities ahead of us and the ongoing volatility in the financial markets will provide us with welcome opportunities to deploy our capital.