Australian Equity LICs after Covid-19

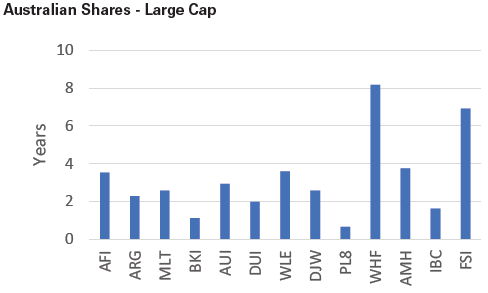

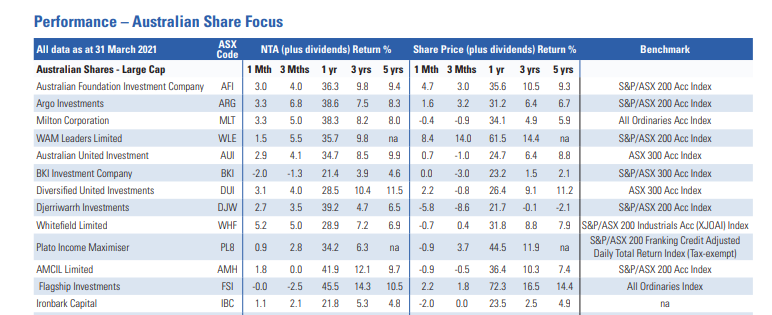

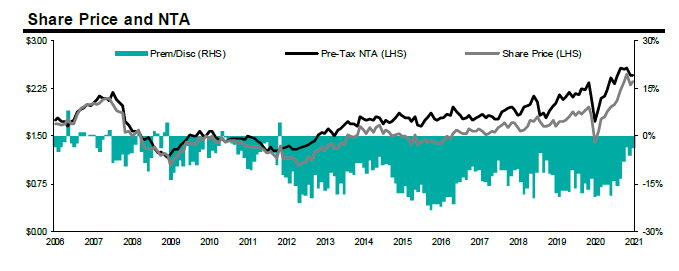

Now that we have gone a full year since the onset of Covid-19 we are able to review the way that many LICs have managed their dividends through a falling market followed by a sharply rising market. While most have maintained their dividends it is worth looking a little closer to ask how sustainable some of those dividends may be. While we won’t speculate how other LICs will fare going forward it is clear that FSI has a responsible Dividends policy and its payments are supported by long-term strong performance.

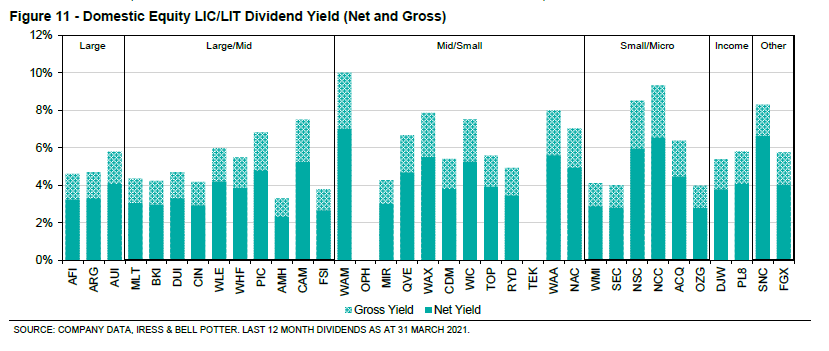

In the recently released March quarter LIC/LIT review by Independent Investment Research (IIR) they observed that investors should look closer to ensure that the LIC they have invested in is maintaining a stable dividends policy.

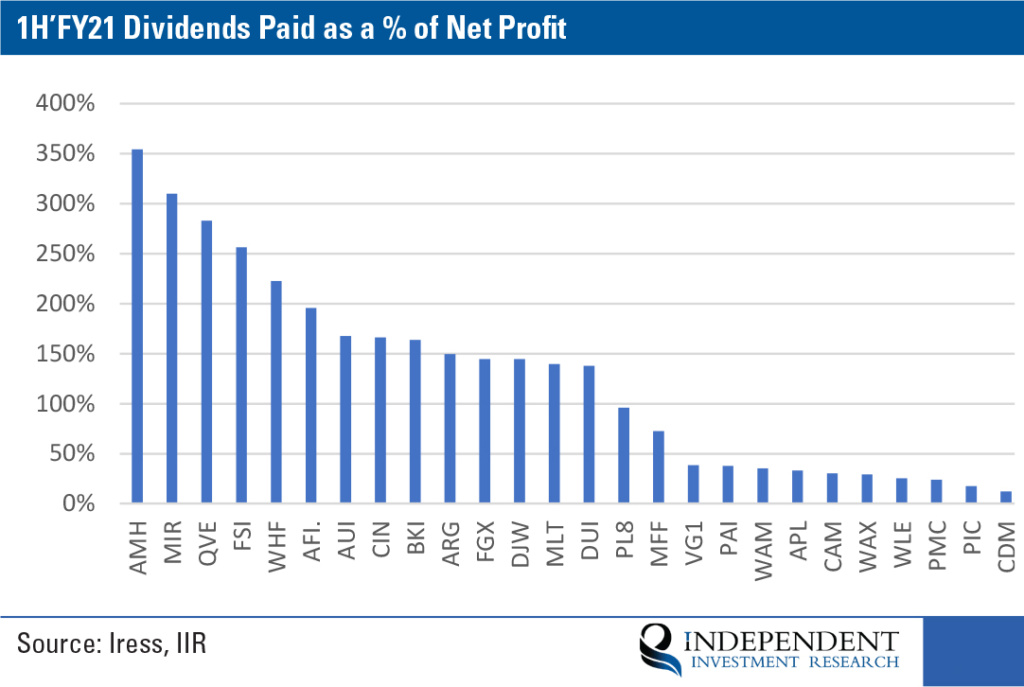

As IIR noted with an estimated (overall) 25% decrease in dividends paid by ASX companies over 2020 it was no surprise that in 1H’FY21 most equity reliant LICs paid out more in dividends than they reported as Net Profit- creating payout ratios greater than 100%, as seen in Chart 1 above. While eyebrows may raise here it should be noted that this was only a 6 month period and many LICs that have low portfolio turnover, may not have generated “book profits” to Dec 31 and some have International Exposure that generates minimal dividends.