Getting Started

Option A: Open an Online Trading Account

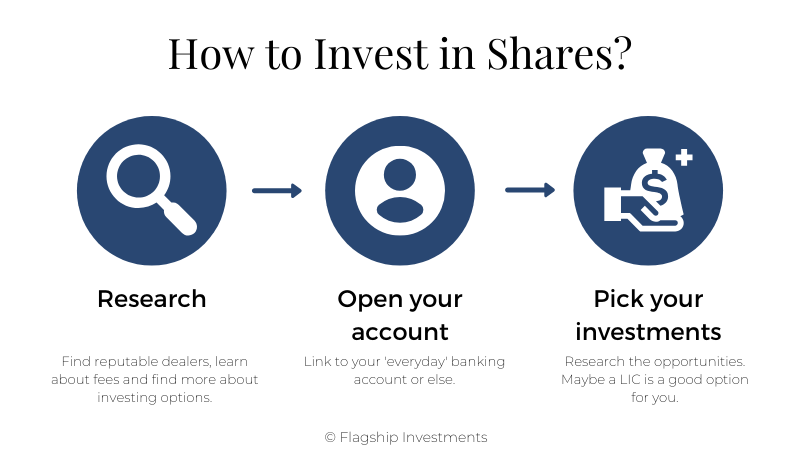

1. Find a Reputable Dealer

There are a lot of scammers out there. Ensure you always check the dealer’s Australian Financial Services Licence (AFSL) registration details and security protocols. ASFLs are legal authorisations that permit financial institutions and businesses to conduct financial services. Search for valid licences through the ASIC Professional Registers Search portal.

2. Look For Low Fees

Don’t get caught in a trap paying exuberant and hidden fees. Make sure you look into each dealer’s charges, including brokerages, account keeping, and entry and exit fees.

3. Platform Usability

4. Investing Options

Option B: Visit a Stockbroker

If you don’t trust yourself to properly assess an online platform, then a traditional stockbroker is another sound option. Stockbrokers monitor your portfolio for you and can buy and sell shares at your instruction. Again, we emphasise the importance of doing your due diligence. Search for a reputable professional or organisation you can trust. Read their reviews, visit their websites, and check out their LinkedIn profiles to determine if they’re right for you.

A good place to start is the find a broker or adviser tool on the Australian Securities Exchange (ASX) website. It contains a list of all licensed brokers and advisers in Australia and is a great jumping-off point for those who don’t know where to start.

Choosing What to Buy

Buying Shares Directly

Buying Shares Indirectly

This refers to buying shares collectively rather than owning shares individually. The three main ways investors can do this are via:

- Managed share funds — collate money with other investors to purchase stocks in different companies.

- Exchange traded funds (ETFs) — passive investment funds that track an index, commodity, or basket of assets.

- Listed investment companies (LICs) — actively managed, independent companies of which you can purchase shares.

Making the Right Investment

Once you know how you want to invest, you’ll need to research where to invest. Ask yourself the following questions to make a choice that works for you.

- Does the company have a good financial outlook

- Will its goods/services be of high future demand?

- Does the company have the room, potential, and opportunities to grow?

- Who are the company’s competitors and does the industry have a fruitful future?

Things to Look Out For

Many investors get trigger-happy when buying shares but this is an easy and fast way to lose your money. Instead, focus on making quality investments that can offer long-term returns. Here are some insider tips:

- Cheap doesn’t always equal good value.

- It’s not about how many shares you own but how those shares can increase in value over time.

- A diversified portfolio always outperforms a uniform one.

- Wealth often accumulates from consistent growth rather than quick wins.

- Never invest more than you can afford.

One Final Thing

Investing in shares isn’t difficult, but some strategies are better than others. To make the most out of your investments, we believe that personal interest and research are key. Start by looking into companies in industries that interest you. Once you have narrowed them down, conduct some research into their performance and growth strategies. Responsible investors look for things like ESG commitments, financial health, and market trends — all factors that influence stock performance in the long term.

Start Investing in Shares With Flagship Investments

Flagship Investments Ltd is a listed investment company that has been around for over 20 years. When buying an LIC, you don’t just buy one share. You buy into a company that owns a diverse portfolio of shares professionally managed by an appointed manager. Our investment strategy centres on the view that business economics drive long-term investment returns, and investing in high-quality business franchises with the ability to generate predictable, above-average economic returns will produce superior investment performance.

If you’re ready to invest in a portfolio that continues to outperform the All Ordinaries Index and pays semi-annual dividends to shareholders, then Flagship Investments might be the LIC for you. Speak with your broker about purchasing FSI shares today.

Flagship Investments Limited (FSI), ABN 99 080 135 913, is a unique ASX-listed invested company as the Manager is only remunerated on investment outperformance.