Flagship Investments Limited (ASX: FSI) is a strong and consistent dividend-paying company that has significant retained earnings and franking reserves to enable it to continue paying its shareholders with a reliable stream of fully franked dividends.

The value of FSI grew strongly over the 6 months to 31 December 2023. As can be seen in Table 1. FSI shareholders enjoyed over 16% NTA performance during that time. For a growth portfolio in a period of rising interest rates, such a return is a good achievement, a testament to the stock selection skills of the investment manager EC Pohl & Co.

| Net Tangible Asset Value | ||

| Pre-Tax NTA | Post-Tax NTA | |

| (After tax paid and before Tax on unrealised gains) | (After tax paid and assuming tax on unrealised gains were paid) | |

| 30 June 2023 | $2.080 | $2.028 |

| 31 December 2023 | $2.373 | $2.240 |

| NTA Growth | $0.293 | $0.216 |

| Add Dividend paid on 30.8.23 | $0.049 | $0.049 |

| Total Return in cents | $0.342 | $0.265 |

| Total Return as a % | 16.4% | 13.1% |

Table 1 source: FSI published monthly NTA and Dividend data

An LIC’s NTA is an after fees and tax-paid number

It is important to understand that FSI’s 16.4% total return over the 6 months was after the running costs of the company have been paid, and after tax has been paid on realised gains in the portfolio. Needless to say when portfolio returns are high, tax paid is not an insignificant amount.

Franking Credits in an LIC portfolio

A benefit to Listed Investment Company (LIC) investors such as Shareholders in FSI is that an LIC is a wonderful vehicle to pass dividends through to shareholders as well as all tax paid by the company on realised gains via franking attached to those dividends. While the dollar or percentage value of that franking might not appear in published performance tables most shareholders are very aware of its dollar value to them.

Portfolios that invest in profitable stocks can earn additional franking credits because these companies pay fully franked dividends. The additional credits in those dividends accumulate in the LIC accounts in readiness to be passed through to investors.

LICs can build a franking reserve to pass through to shareholders

When an LIC performs strongly for a continued period it can build up credits in excess of those attached to dividends, and build a “franking reserve”.

A very popular feature of LICs are that they are able to pay dividends to shareholders even when the portfolio has a bad, and even negative performance year. They may not realise any gains (to pay tax and earn franking credits) but they can still utilise their franking reserve to attach franking credits to their dividends.

Shareholders love it when an LIC passes franking credits on as the credits are able to be offset against the shareholder’s own taxation liabilities.

LICs need to be responsible with the Dividends they pay

In the 2023 FSI Annual Report, it was detailed that a specific objective of the company is to “provide Shareholders with a fully franked dividend, which over time, will grow at a rate in excess of the rate of inflation.”

That becomes possible when a company generates consistent market outperformance. As we can see in Table 2, FSI has certainly done this, with strong outperformance for over 25 years.

| UNDERLYING PORTFOLIO PERFORMANCE | |||||

(1 May 1998) p.a. | |||||

| Portfolio^ | |||||

| ASX All Ordinaries Index | |||||

| ASX All Ord Accumulation | |||||

| ^ Source: EC Pohl & Co Pty Ltd Gross performance before impact of fees, taxes and charges. Past performance no predictor of future returns | |||||

Table 2 source: Flagship Investments Limited Shareholders December Quarter Report

While an LIC board may want to pay shareholders as big a dividend as possible, they also must ensure it is not to the detriment of future returns by unnecessarily shrinking the size of the investment portfolio. Logically you would want a strong-performing investment manager to have as big an investment pool as possible. Firstly to keep making more money for shareholders and also to minimise the impact of fixed operating costs of the company. A responsible dividend policy allows FSI to meet the objective of preserving and enhancing the NTA backing per share by compounding the performance of the manager.

Flagship Investments has paid shareholders a reliable, and growing dividend

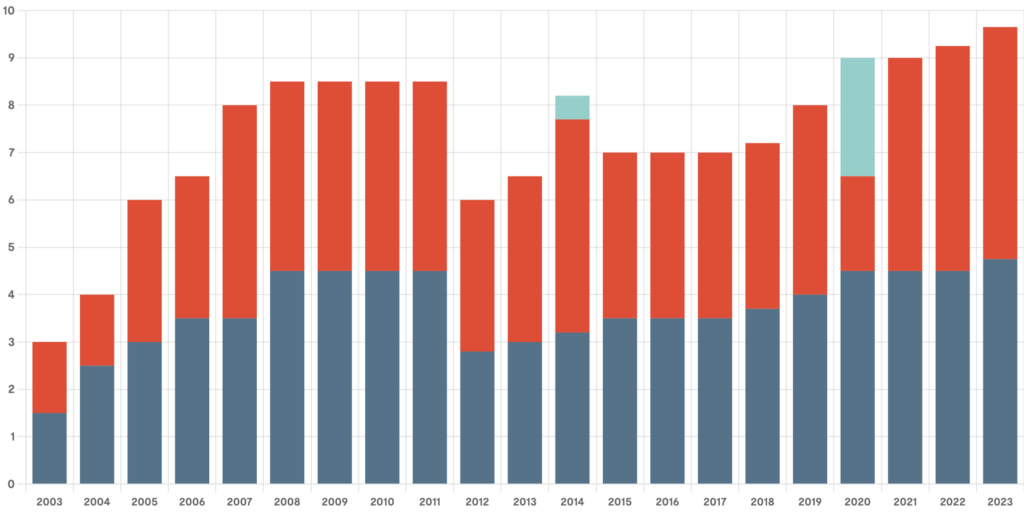

Chart 1 shows that FSI pays a reliable stream of fully franked dividends. It also shows it is capable of and prepared to pass strong performance through to shareholders by way of special dividends where appropriate.

Dividend Per Share (Cents)

Table 3: Dividend per Share (Cents) Performance

FSI is a listed investment company that pays a desirable dividend yield

In 2023 FSI paid 9.65 cents per share in fully franked dividends. Against the closing share price at 31 December 2023 of $1.805 this represents a Dividend Yield of 5.35%. If you also take into account the franking credits attached the grossed-up dividend would be approximately 13.7cps representing a gross dividend yield of 7.6%.

Flagship Investments is recognised for paying a desirable, consistent and responsible dividend to shareholders.

An LIC board must be responsible with Franking Credits

Companies such as FSI require a Board that has good foresight to manage the balance between passing franking credits through to their Shareholders while retaining a pool that will ensure future dividends will always have franking credits to attach to them. It is disappointing to an LIC investor when an LIC does not attach full franking to ordinary dividends, or heaven forbid pays a dividend with no franking at all.

Flagship Investments has paid fully franked dividends for all dividends except August 2011 to its shareholders.

FSI has considerable Dividend Reserves

In 2023 FSI paid $2.5m1 of dividends from a net asset value of a little over $50m. In its 2023 Annual Report, it disclosed it retained a Dividend Reserve of over $10.2m2. That indicated a last 12 months’ Net Dividend cover of 4.1 times.

This confirms the foresight of the FSI Board to declare regular dividends with desirable yields while building a Dividend Reserve that is sufficient to ensure it has the ability to pay Ordinary and possibly even Special Dividends to shareholders in the future.

FSI has considerable franking credits

In the 2023 Annual Report FSI disclosed it also has a Franking Reserve of $4m3. As the company has 25 million shares on issue that would represent around $0.15cents of franking credits per share, confirming that the company is very capable of continuing to pay fully franked dividends to its shareholders.

2024 a year of falling interest rates good for Growth investment

With the expectation by the market that major central banks are nearing the end of their rate-hiking cycles, growth-oriented portfolios are looking towards a positive 2024. Flagship Investments is a traditionally strong dividend-paying LIC and looks forward to utilising its strong long-term performance by rewarding its Shareholders with consistent fully franked dividends.