The Market

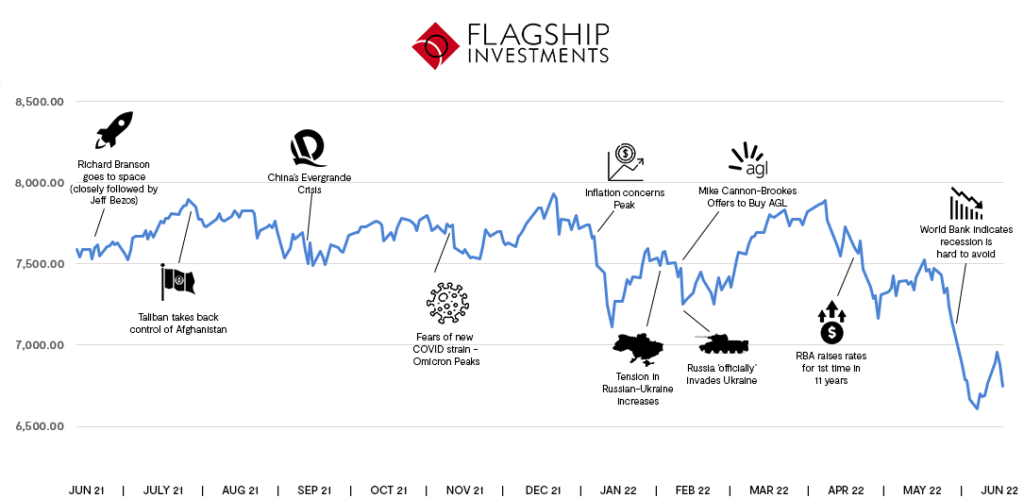

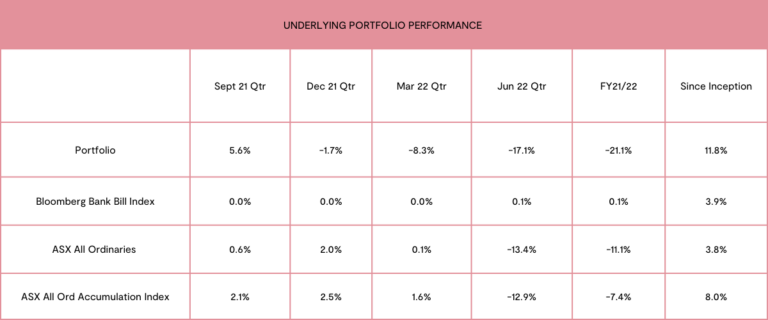

In terms of the financial markets, the 2021/2022 financial year has drawn to a close in a spectacular fashion. The ASX All Ordinaries Index has decreased by 11.1% over the full year, as a result of a 13.4% decrease in the last quarter. This is in a stark contrast to the astonishing growth that occurred in 2020/2021 when the index increased by 26.4%. The US equity market recorded its worst first half period in 60 years (calendar year to date), shifting the market into bear territory and, unfortunately, the Fed has signalled more rate hikes are to come, noting the difficulty of bringing down inflation without triggering a recession. This is a similar problem facing central banks globally, with the Eurozone under even greater pressure due to the ongoing Russia-Ukraine conflict.

Given the current macro climate, it will be interesting to see what is written about the financial year 2021/2022 in five or ten years’ time: is this the beginning of an inflation-driven global recession or is this a dint due to interest-rate speculation that normalises and rebounds?

EOFY 2022 Wrap Up

“In the real world things fluctuate between pretty good and not so hot. But in the markets they go from flawless to hopeless” – Howard Marks

Given the last two to three years this quote seems as true as ever and taking a long-term approach allows us to see the turbulence as a normal part of the market. This cycle through periods of excesses and then corrections can be seen in the movements of the ASX All Ordinaries Index, which is down 11.1% this year and over the past 24 years has returned an average of 3.8%. However, the annual return in any one year has never been within 10% of the average, instead, we have five years where the losses are greater than 10% (the lowest being negative 26% in FY2009) and nine years where the gains are greater than 10% (highest being 26.4% in FY2021), the remainder fall somewhere in between, but nowhere near the average. If you’re wondering, the FSI portfolio has generated annual returns of 11.8%, with only two years of losses of more than 10% (lowest was negative 24.1% in FY2008) and 14 years of gains greater than 10% (highest was 40.7% in FY2021).

Quarter by Quarter

In the first quarter of the financial year, the outlook was positive. Monetary policy was favourable, corporate earnings were strong, consumer spending was buoyant and labour markets were resilient despite numerous COVID-related restrictions. The only red on the score card appeared from concerns in China’s property market.

In the second quarter despite a rollout of vaccines, the new COVID strain caused some concern. Supply chains were still constrained and persistent inflation raised concerns over central bank policy settings. “Transitory inflation” was the term used frequently, allowing central banks to hold interest rates and remain upbeat in their forecasts.

In the third quarter, Russia invaded Ukraine. The West was quick to issue sanctions and multinationals started closing down any operations linked to Russia. However, the war amplified energy and food price issues straining an already constrained supply-side environment and pushing inflation higher. Central banks began raising rates and forecasting future increases. Particularly for growth-orientated stocks, the rising interest rate environment drove declines in equity valuations across the board.

By the fourth quarter, the high inflation readings were a major detractor for all sectors of the financial markets. Despite numerous interest rate increases during the quarter, with low unemployment continuing, retail sales remained resilient. In addition, there has been little done to improve supply-side inflationary factors such that the current environment is likely to continue in the near term.

Over the Long Term

“Time is the friend of the wonderful business, the enemy of the mediocre.” Warren Buffett – Letter to Shareholders 1989

While market uncertainty continues, it is more important than ever that one has a strict investment process. It is vital not to get caught up in the hype and noise of the daily market movements, and instead invest with a long-term approach. A sound investment philosophy sets out a number of ‘rules’ or ‘procedures’ to fall back on when the market noise gets too loud. Companies that have a sustainable competitive advantage will always be well-placed to withstand short-term headwinds, regardless of market conditions, maintain market share and ultimately find new ways to grow.

It can be challenging to recognise the potential in companies, particularly those that are in the growth stage of their life cycle. It can also be difficult to evaluate the ‘narratives’ that some companies are telling about themselves. To invest in a company in the growth stage of its life cycle it is important to balance the company’s narrative alongside its numbers.

By drilling down into a company’s financials and growth plans in a careful, considered and committed way, it is possible to identify the quality growth stocks that will prosper over the long term. Their ability to be flexible, to move quickly to take advantage of opportunities as they arise, and to capitalise on market trends and demand, will continue to support the ongoing success of such businesses, and provide significant long-term opportunities for their investors.