The boards of Listed Investment Companies (LICs) frequently face inquiries about the discount between the share price and the net tangible assets (NTA). This discount represents a reduction in value for shareholders, as they are unable to realise the full underlying asset value when selling their shares. In a previous article, we have considered the option of commencing share buybacks to narrow the discount. In this article, we consider another solution often proposed- converting the LIC into a managed fund. Let’s examine the advantages and disadvantages of both structures, with a focus on the long-term benefits for investors who think the same way as FSI and are aligned with our investment philosophy.

Understanding NTA and Share Price Discounts

NTA discounts are a prevalent characteristic of LICs. In the monthly ASX LIC report, approximately 95% of LICs typically trade at a discount. The NTA discount is calculated as the percentage difference between the month-end NTA per share and the closing share price. For instance, at the end of February 2025, FSI’s NTA was $2.545, while its share price was $2.11, resulting in a $0.435 difference, or a 17.1% discount to NTA. This discount arises from the interplay of market participants trading a fixed pool of shares, where buyers seek to purchase shares at a discount, and sellers aim to achieve the best possible price while meeting their liquidity needs. The level of the NTA discount can therefore be influenced by various factors, including market sentiment, investor confidence, an individual’s circumstances, liquidity, and perceived management quality.

LICs vs. Managed Funds: A Comparative Analysis

A key argument in favour of managed funds is their variable unit structure. Managed funds issue new units at NTA when investors buy in, and they redeem units at NTA when investors sell, ensuring transactions occur at the net asset value. This mechanism provides certainty for investors when entering or exiting the fund. However, other critical aspects of investing, such as taxation and distributions, warrant careful consideration.

LICs pay tax on profits, including realized gains, at the corporate tax rate and can distribute franked dividends to investors. Franking credits represent tax that has already been paid and offer a tax credit to investors, preventing double taxation. In contrast, managed funds distribute their income in full each year, and these distributions are pre-tax, creating a tax liability for the investor.

For example, consider an individual investor in the 37% tax bracket ($135,000 – $190,000 income):

LIC Dividend | Fund Distribution | |

Investment Income: | ||

Cash Amount | $700 | $1,000 |

Franking Credit | $300 | – |

Total Benefit | $1,000 | $1,000 |

Taxation for Investor | ||

Cash Received | $700 | $1,000 |

Declared Income | $1,000 | $1,000 |

Tax at 37% | $370 | $370 |

Franking Credit Applied | ($300) | – |

Tax Payable | $70 | $370 |

Net Cash Benefit | $630 | $630 |

*Note: Some fund distributions do include franking credits, but typically not to the same extent as LIC dividends.

In this simplified scenario, the net cash benefit is the same for both LIC dividends and fund distributions. However, the timing of tax payments differs, with fund investors facing a lump-sum liability, which may not be suitable for all investors.

Furthermore, the level of dividends or distributions also varies. LIC dividends are determined by the board, and at FSI, the goal is to increase dividends above the rate of inflation while maintaining a consistent income stream for investors. Managed funds, on the other hand, must distribute all profits each distribution period, leading to potentially inconsistent distributions that can affect investors, particularly those close to a higher tax bracket.

Consider an investor with a fixed annual income of $185,000 (in the 37% tax bracket, but moving to 45% above $190,000) and variable distribution income:

FY25 | FY26 | FY27 | Total | |

Fixed Income | $5,000 | $5,000 | $5,000 | $15,000 |

Tax Payable | $1,850 | $1,850 | $1,850 | $5,550 |

Variable Income | $5,000 | – | $10,000 | $15,000 |

Tax Payable | $1,850 | – | $4,100 | $5,950 |

This simplified example illustrates the potential tax implications of variable distributions.

Related to distribution variability is the opportunity cost of lost compounding. Managed funds are required to distribute all profits each year, and while some investors may opt for dividend reinvestment plans (DRPs), many take the cash payment and manage those funds themselves (investing or spending the distribution). In contrast, LIC boards have the discretion to reinvest a portion of the gains, allowing those funds to compound within the portfolio over time. This feature enables LIC investors to benefit from long-term capital compounding.

This is highly aligned with FSI’s objective of generating medium to long-term capital growth for investors.

Conversion to a Managed Fund: Implications and Considerations

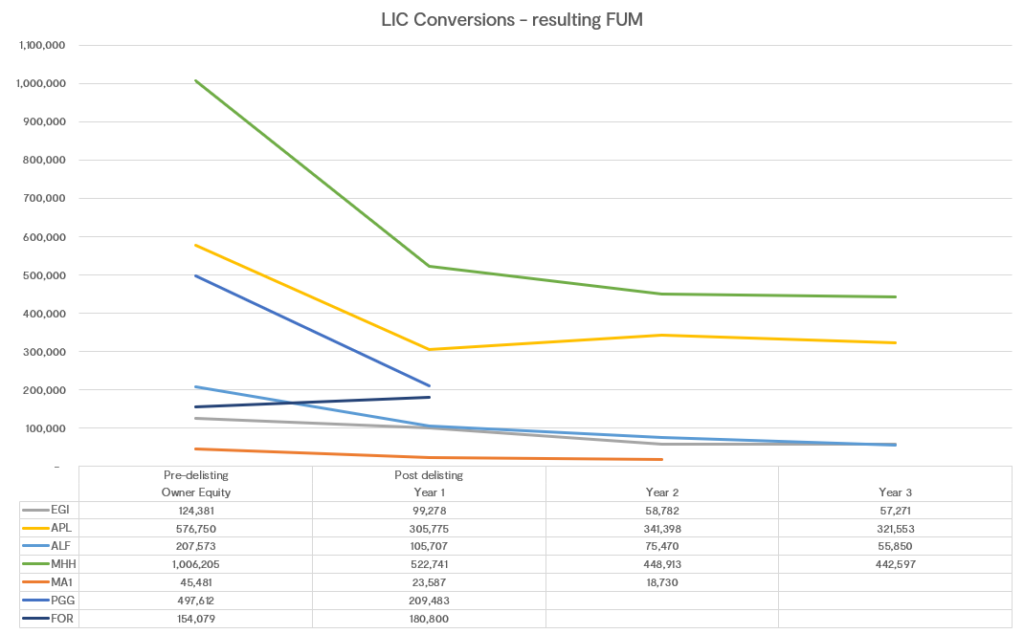

Despite these differences, some parties advocate for converting LICs to managed funds to allow investors to realise their investment at NTA. However, investors who promote this transition often seek short-term gains, aiming to maximize their personal profit through an exit upon conversion. This behaviour is frequently observed in LICs that have converted to managed funds, where a large number of units are redeemed immediately following the transition as shown in the table below.

– Noting that MA1, PGG & FOR have only recently converted and therefore do not have 3 years’ worth of data.

The rationale for this exodus could be attributed to many things, most of these LICs did not have a terrible performance track record, but perhaps frustration regarding the NTA discount was enough to stimulate investor action.

This is not the behaviour of a long term investor who is looking for long term value via compounding returns. Investors that are aligned with the philosophy of FSI have bought shares for the long term capital appreciation, they believe in patient investing based on high conviction in quality companies and the fact of the discount means that for every additional share they buy they are getting great value for money.

Reduced FUM

It’s important to acknowledge the inherent conflict of interest in this situation. Investment managers of LICs, who are paid management fees based on the portfolio size, may experience a significant reduction in revenue due to outflows following a conversion. Therefore when a Manager objects to the managed fund option, this conflict must be carefully considered by a board acting in the best interests of shareholders.

Furthermore, the decision to convert to a managed fund and potentially face large redemptions has significant consequences. To meet redemption demands, substantial asset sales may be necessary, potentially resulting in taxable distributions for remaining unit holders. The lower FUM also diminishes economies of scale, increasing the proportion of fixed operating costs (e.g. audit, registry, and administration) relative to the portfolio value. This disincentivises long-term investors and contradicts the philosophy and goals of FSI.

Impact on Investor Control and Governance

An often-overlooked aspect of this debate is the impact on investor control and governance. LICs grant investors direct ownership of the Company and voting rights, empowering them to influence the company’s direction and governance at the annual general meeting. Converting to a managed fund would strip investors of this direct control, as they would own units in the fund rather than shares in the company. This loss of control can be a major disadvantage for investors who value active ownership and participation.

Fees and Costs

Another crucial consideration is the difference in fee structures between LICs and managed funds. It is essential to compare management fees, performance fees, and other expenses to understand how a conversion to a managed fund could affect the overall costs incurred by investors. Any potential hidden costs associated with the transition should also be evaluated. The impact of fees on long-term returns must be carefully weighed against any perceived benefits of a conversion.

Liquidity and Trading Dynamics

While liquidity is an important factor, it’s necessary to delve deeper into the trading dynamics of each structure. LICs are traded on the stock exchange, offering liquidity but also exposing them to market volatility and potential discounts or premiums. Managed funds provide liquidity through redemptions, but these can be subject to delays or limitations at the discretion of the Responsible Entity, particularly during periods of market stress. A comprehensive analysis of how a conversion would alter the liquidity profile for investors and the potential consequences for their ability to trade their investment is essential.

Impact on Investment Process

Most importantly in considering the option of delisting to a managed fund is the impact on the investment process. FSI invests in quality growth companies with the potential to generate predictable, above-average economic returns. FSI employs a high-conviction, long-term investment approach, focusing on holding investments for a minimum of 3-5 years and strategically allocating the portfolio based on a 5-year internal rate of return (IRR). The timing of buying, selling, and re-weighting investments and cash is determined by a portfolio construction formula.

The fund structure allows for applications and redemptions at the discretion of investors. Applications and redemptions at random intervals disrupt the timing of trades, this can lead to buying and selling at times that are not aligned with the intended portfolio management process or alternatively holding more cash than would normally be advisable. While occasional deviations from the intended investment process might yield better outcomes, introducing such variability into a disciplined investment management approach is unlikely to produce consistent long-term outperformance. It is far more likely that these adjustments to the investment process will lead to underperformance compared to a close ended structure.

FSI aims to deliver consistent long-term outperformance, strategically grow the company to achieve economies of scale, and provide investors with capital growth and reliable investment income that aligns with their portfolio and long-term objectives.

Conclusion

The decision to convert to a managed fund involves numerous considerations, and the short-term benefit of transitioning from market-based pricing to NTA-determined valuation does not guarantee long-term shareholder benefits and carries substantial risks. It is the board’s responsibility to continuously evaluate the merits of various capital raising activities and alternative structures, ensuring they provide long-term value to shareholders. For FSI, the LIC structure remains the most suitable for delivering balanced long-term benefits, and we are committed to providing these benefits to our shareholders for many years to come.