What is a Share Buy-Back?

A share buy-back occurs when the issuing company buys its own shares off Shareholders. The Shareholders are paid an amount per share and the company voids the shares. This reduces the number of shares on issue, concentrating ownership and reducing the market capitalisation of the company. An off-market buy-back occurs when a company makes an offer to Shareholders as a whole and the buy-back usually has a mix of capital proceeds and dividend income which may have franking credits attached. An on-market buyback occurs when the company buys its own shares on an exchange in the ordinary course of trading.

There are many reasons why a company might decide to buy back shares, but for a Listed Investment Company (LIC) the main reason is because the shares are trading at a discount to the Net Tangible Assets (NTA) per share and the effect of an on-market buy-back will hopefully reduce the discount.

Buying $1.00 for 80 cents

For a variety of reasons the shares of an LIC may trade at a discount or premium to the NTA. The behaviour of investors in the market can be influenced by a number of strategic or emotional reasons and this is reflected in the share price of a company. As at 30 April 2023, Flagship Investments Limited (ASX: FSI) shares last traded at $1.71 while the NTA was $2.186 per share, the $0.476 difference is a 21.8% discount to NTA. Engaging in an on-market share buyback, the company strategically purchases its own shares, typically aiming for prices up to a predetermined discount to the Net Tangible Assets (NTS), such as 10%, thereby enhancing shareholder value through careful market operations. Shares would be bought at a price up to $1.9674, which is good for the remaining shareholders who see the share price increasing and the value of their holding increase.

It can also be good for the company who is spending $1.97 to buy assets valued at $2.186. This process of buying “$1.00 of assets for 80 cents” has very tangible value given that an LIC like FSI is investing in listed equities and therefore the market value of its assets are accurate based on the closing market prices of the underlying investments. There are very few businesses with this sort of transparency and accuracy of regular asset valuation. Therefore, the opportunity to buy back shares when the share price is less than the net assets per share of a company is deemed an

effective use of capital and can preserve the share price at a level that reflects the value of the business.

Buy-back Theory

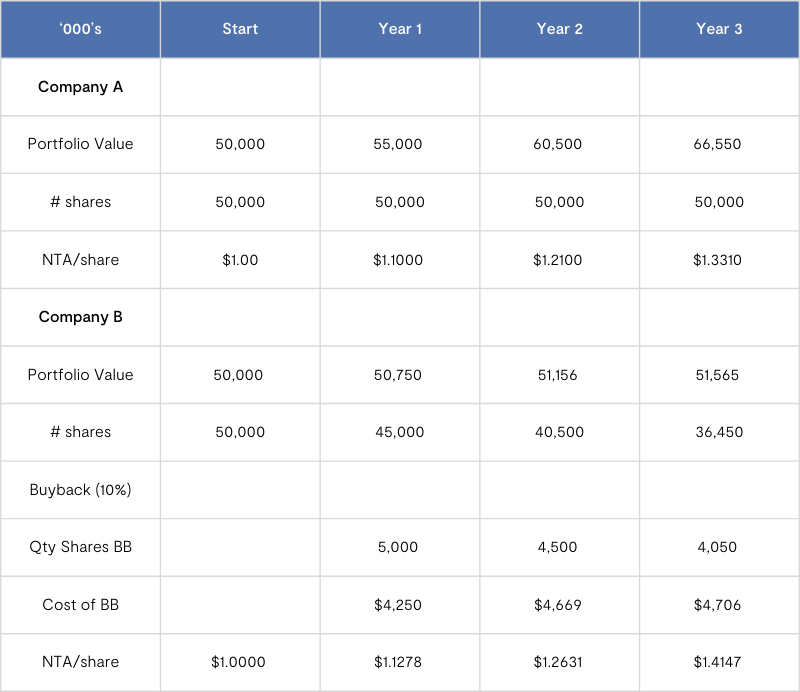

This process, often referred to as ‘share buy backs’, where buying ‘$1.00 for 80 cents’ reduces the share capital, directly increases the NTA per share, providing tangible benefits to remaining shareholders. To illustrate the theory lets use a hypothetical example, let’s take two companies: both have an investment portfolio of $50mil and 50mil issued shares, ignoring payables, tax etc their NTA/Share is $1.00.

Both companies generate a 10% return on their portfolio each year. The first company (Company A) compounds their portfolio growth. The second company (Company B) commits to buying back up to 10% of its issued capital each year.

Table 1: Buy-back result in theory:

The theoretical outcome is clear, while Company B has shrunk in the number of shares available and the portfolio has remained relatively the same, the NTA/share has increased by 41.5%. By comparison, Company A has increased the size of its portfolio by 33.1% and the NTA/share has increased by 31.1%. From the same starting point Company A’s NTA is $1.3310 at the end of 3 years and Company B’s is $1.4147.

In which company would you rather have invested?

Buy-back Reality

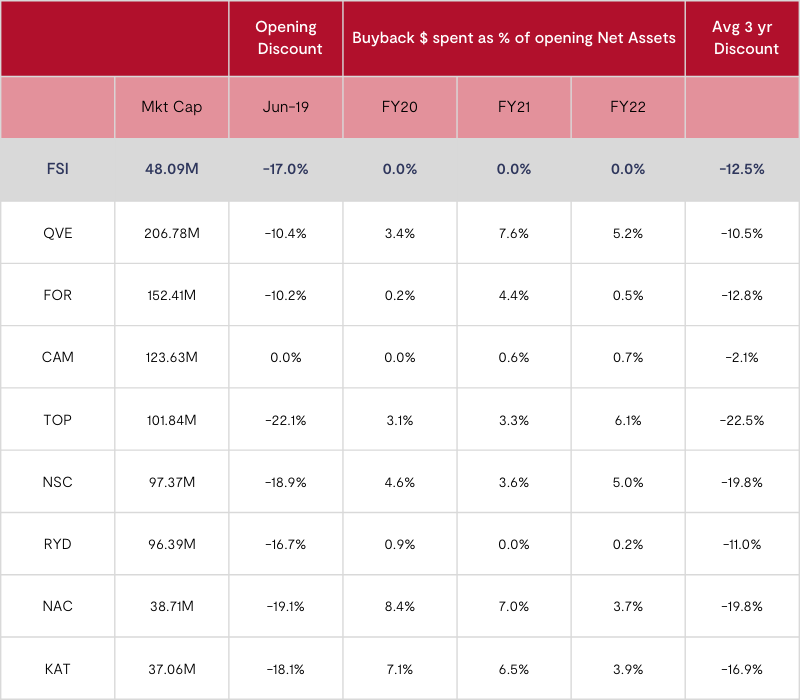

So the theoretical model strongly supports the buy-back process, but what happens in practice? Unfortunately, the neat extrapolations as presented above are unravelled amongst the actions of unpredictable market forces and the operational costs of running a listed company. Often a share buyback program will help in the short term but does not provide a long-term stimulus for trading the real value of the company. And therefore even though a company conducts a buy-back, the average discount does not improve over the long run. The below table shows a comparison between FSI and similar LICs, but these LIC’s have conducted buy-backs over the past three years, the buy-back spend as a percentage of net assets each year and the average share price to NTA discount over the three-year period is presented.

Table 2 Buyback effectiveness:

The share buybacks are initiated and executed according to plan. Shares are bought back at an appropriate discount to NTA and the share price to NTA discount will close. The trading increases the share price temporarily, effectively increasing the value of shares held by remaining shareholders. However, if the demand for shares is not maintained then the share price reverts to the whim of the individual market participants who may trade shares for various reasons. The most damaging is a fire sale of stock at heavily discounted prices which undoes the work of the buyback, the discount will widen and the process needs to start again.

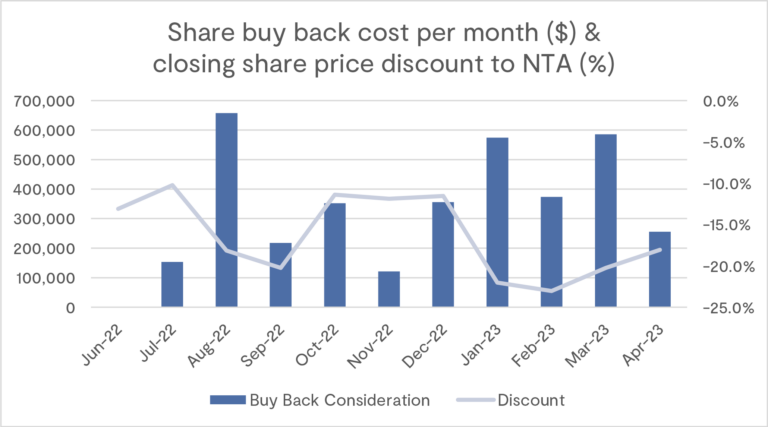

We see this frequently in entities that run buy-backs, where the benefits of the buy-back are easily undone by subsequent trading. As exemplified in the chart below. This LIC ran a buy-back throughout the 22/23 year. The opening discount was 13.1%, they have spent $3,646,000 buying back shares (3% of opening net assets) and at the close of April 2023, their share price to NTA discount is 18.1%. Their on-market buyback represented 30% of all trading activity, but in the end, all that has effectively happened is that they have distributed cash with no tangible gains for long-term Shareholders. Their year-to-date portfolio performance has been positive but their NTA has decreased by 1.2% and the share price has decreased by 6.8%.

Graph 1 Buyback outcome 22/23:

Compounding Cash

The main downside of a buy-back is the reduction of total assets as cash is used to buy shares (as was shown in Table 1). In a cash-generating company it makes sense to buy-back undervalued shares, however in a cash-investing company the goal is to grow value and compound over time. The process of buy-backs requires use of cash reserves and while the short-term use is deemed beneficial it ultimately reduces the pool available for investment. It can change the way the investment portfolio is managed and most importantly removes the opportunity to compound gains.

As Warren Buffett said “compounding is the 8th wonder of the world” and trading a portfolio too soon could result in lost growth over time. When a company uses its free cash to continue buying stock it is effectively shrinking the total net assets over time. At some point, the fixed costs become uneconomical compared to the asset value and the company is forced to raise capital from the market. Depending on the timing and the impact of external factors this may require discounting to attract funding. This may not directly affect the share price but it does undermine the work of the share buyback in terms of effective use of capital and value to long-term shareholders, given the additional costs of brokers, lawyers and regulators to complete a capital-raising transaction.

The whole process of conducting a buy-back over time and then replenishing the investment pool with capital raising has the additional downside of management distraction. The bandwidth required to execute a strategic buyback and then promote the company for additional investment is attention that should be focused on executing the company’s strategy and monitoring the actual business of making great investments and building wealth over the long term. The distraction from core business inevitably leads to poor investment performance and will lead to diminishing shareholder value. Whereas, by reinvesting cash in the portfolio and compounding the gains, the size of the company will grow. The benefits of a larger portfolio are the economies of scale in relation to fixed costs and negotiating power for variable items. In addition, larger LICs are more likely to trade at a premium or smaller discount. This is not always true but is more likely given that there are more shares on issue, therefore more shareholders are likely to trade for their independent reasons. Larger LIC’s are also covered more broadly by research houses and media, therefore, gaining greater investor exposure and stimulating demand.

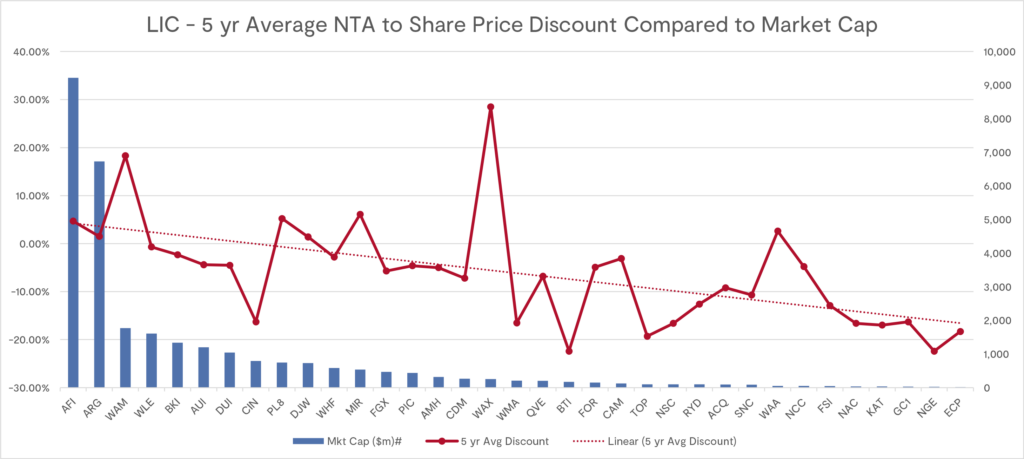

The Real Goal

Larger LIC’s generally have a lower discount, a graphical depiction of Australian Equities focused LIC’s 5yr average discount sorted by market cap is shown in the graph below. Looking at the data from this graph, LIC’s with a market cap under $100mil have an average 5yr discount of -12.9%, LIC’s between $100mil and $1,000mil have an average discount of -4.6% and LIC’s with a market cap over $1,000mil have an average premium of +1.8%.

Flagships is right on the average= 12.9%

Understanding why companies buy back shares, it’s clear that for any LIC, achieving a sustainable market capitalisation through strategic buy-backs can significantly influence long-term shareholder value.

Unfortunately, buy-backs act against growing market cap and expanding the shareholder base. Therefore strategic buy-backs are best executed when the company is of sufficient size to handle short-term cash outflows. Otherwise, the share buy-back is likely to be a sugar hit that only helps the price in the short term and allows an avenue for opportunistic trading as opposed to long-term investment in the company.

The reality is that the entities that maintain a narrow discount are not entities that frequently run buy-backs but who are large businesses and well covered by research houses, financial advisors and general media. Their performance may be average, but they have size and presence in the market, increasing their perception of “safety” and drawing a diverse following of investors.

FSI remains focused on long-term performance:

● Delivering outstanding investment returns by focusing on our strategy of investing in high-quality growth companies that have the ability to generate predictable, above-average economic returns, and

● Providing Shareholders with regular fully franked dividends which over time will grow at a rate in excess of inflation.

FSI continues to explore avenues to raise capital and take action when appropriate to grow the size of the company. The goal is to get to a point of scale where investor interest creates share trading at fair value and consequently, the NTA discount is less likely to be a persistent detractor. However, FSI will not undertake activities that will dilute the value for existing shareholders. Our preference is to compound our track record of performance, sustainably providing capital growth and reliable income for our long-term Shareholders.

We do hope investors will join us in this long-term journey. If you have any questions please contact us at contact@flagshipinvestments.com.au.

NTA, or Net Tangible Assets, represents the real economic value of a company’s assets minus its liabilities and intangible assets. Share buy-backs can affect NTA per share by reducing the number of shares outstanding, potentially increasing the NTA value per remaining share.

On-market share buybacks allow companies to reacquire their own stock directly from the market, which can help manage and stabilise the stock price, enhance shareholder value, and alter the company’s capital structure positively.

The first steps include setting clear investment goals, choosing a reputable online broker or a full-service broker, and starting with an amount of money you are comfortable investing.

Popular online platforms for buying shares in Australia include those offered by major banks and dedicated trading platforms like CommSec, E*TRADE, or Plus500, each providing different features tailored to various levels of experience. For those seeking a more professional approach rather than typical online platforms, consider our broker at www.supernetwork.com.