On the 1st of May 2023, FSI celebrates 25 years since the first money was seeded and investments made. For anyone tracking our performance since inception date has always been 1 May 1988.

This tenure of operation is an incredible milestone in a market where many investment vehicles come and go. The root cause of this longevity lies in a number of factors but ultimately rests in the long-term approach taken by the stakeholders involved.

Long Term Investments

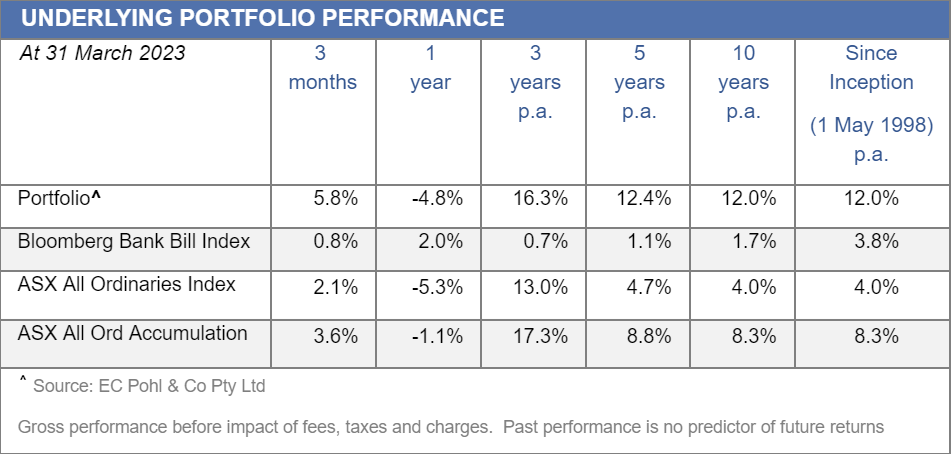

The investment strategy centres on the view that the economics of a business drives long-term investment returns and investing in high-quality business franchises that have the ability to generate predictable, above-average economic returns will produce superior investment performance. To this end when modelling out the returns on a particular investment the Manager is looking at a five-year time horizon, with many investments held in the portfolio beyond this period. The result of the investment process is the performance as outlined above, 12.0% versus the All Ordinaries Index which has grown by a positive 4.0% over the same time period.

Long Term Shareholders

FSI is fortunate to have a large portion of its register as long-term investors. While there might be some downside to a less traded company, we are proud that investors have high conviction in our business and have maintained faith through multiple market cycles. We recently spoke to a Shareholder who has been invested in FSI for over 20 years. When asked how FSI fit into their long-term strategy, they said:

“My long-term investment strategy is to invest in companies that have sustainable business models, can increase their earnings per share over time and that pay regular, fully franked dividends. FSI has a similar philosophy and in having their team manage the portfolio, I get the expertise of ongoing disciplined analysis around stock inclusion and exclusion as well as excellent regular shareholder communication.”

Long Term Management

Dr Manny Pohl AM has been managing the FSI portfolio since its inception. As a substantial Shareholder as well, Manny is highly aligned with the performance of the business and long-term Shareholder returns. The long-term involvement of such a highly regarded investment professional provides confidence in the ability of FSI to maintain its long-term strategy, to maintain its performance and to honour its commitment to Shareholders of creating Shareholder wealth through active management of a portfolio of ASX-listed quality growth companies.

With 25 years of very respectable performance, we are looking forward to the next 25 years growing together with our Shareholders.