At Flagship Investments, we are committed to responsible investing and are proud to support the Principles for Responsible Investment (PRI) Initiative.

As a responsible investment company certified by the Responsible Investment Association Australasia (RIAA), we know how Environmental, Social, and Governance (ESG) factors affect performance. Therefore, to protect our clients’ capital, we’ve always insisted on understanding ESG holistically to gauge investment potential.

The Importance of Upholding ESG Principles

A portfolio manager’s role is to grow the wealth of clients who entrust their funds with them in a financially responsible way. In recent years, however, there has been a rising demand for portfolio managers to grow this wealth in an environmentally and socially responsible manner as well.

Issues like climate change, human rights, and corporate accountability are now at the forefront of many people’s minds. Companies with strong ESG policies not only align more with people’s morals but they also offer more sustainable growth, making them particularly appealing to long-term investors. As a result, more and more investors are wanting to make sure the companies in their portfolios engage in responsible practices.

In our view, accounting for ESG risks and opportunities can lead to more informed investment decisions that are both ethically and financially sound. As such, we believe any manager who does not yet have an ESG policy in place cannot make the most educated investment choices for their clients.

Flagship Investments, through our manager, EC Pohl & Co, has always considered ESG factors as a material part of long-term investment outcomes.

Any company we assess as being investment-grade, aka, a ‘Quality Franchise’, inherently requires a full assessment of ESG factors. This is done to ensure they have a sustainable business model that can generate predictable earnings growth for our clients over time. These factors can include:

- Environmental: climate policies, emissions targets, conservation initiatives, energy usage, pollution/waste, and the humane treatment of animals

- Social: workers’ rights, living wages, labour standards, charitable donations, anti-discrimination policies, volunteer work, and safe working conditions

- Governance: transparent policies and procedures, clear accounting/financial methods, diverse leadership, responsible use of power/influence

We Put Our Money Where Our Mouth Is

A fund manager can have a flash website that espouses virtuous motherhoods about ESG in their portfolio – that they invest for “good” reasons, which is a positive for all. It is worth noting, however, whether these investments are only made with your money.

If we look at what these fund managers do with their own money, then we can see whether or not they are truly committed to the PRI Initiative. If we looked and saw an investment team putting their personal money into stock that they would rule out of their company’s portfolio, then that would not just be hypocritical, but it would identify a conflict of objectivity.

While most fund managers maintain a register that discloses where their team’s personal investments are held, there is no obligation to make this public. That’s why it’s a good idea to look for a manager who openly declares the following two commitments:

- Their portfolio will only contain companies abiding by sustainable investment principles and;

- All members of their investment team abide by the same principles when investing their own money.

At Flagship Investments, our investments team does exactly this, declaring that our portfolio is ESG compliant. In fact, we even take things a step further by ensuring our investment team members do not invest in any company that is not in the Flagship portfolio.

This is a demonstration of true commitment with our own money, not just our clients’. The statements about abiding by the PRI Initiative on our website are not just word service — They are a line-in-the-sand commitment by the manager and investment team who walk their talk.

Identifying a Fund Manager’s PRI/ ESG Commitment

Unfortunately, there is a lot of tokenism and website gloss out there about being a responsible investor. As a result, it is difficult for investors to know if their fund manager is truly committed to the claims they make.

Recent ASIC action against Diversa and Vanguard for alleged greenwashing highlights the scope of the problem within the industry. This means it can be extremely difficult for an investor to know what commitment the manager has to the various aspects of responsible or ESG investing.

Thankfully, there is a way to distinguish genuinely responsible investment companies from duplicitous ones. Responsible Returns is a website that has been created by RIAA to help investors find, compare and choose responsible and ethical financial companies operating in the following areas:

- Superannuation

- Banking, and;

- Investment products

This website can be used to find responsible companies that best match a person’s values and interests. It lets people look at a product to see the positive themes they embrace, as well as the ethical issues they avoid.

Investors can now use Responsible Returns to look inside the ESG aspects of our portfolio and investment manager. Simply visit the Flagship Investments Profile on their website and read our manager’s comprehensive statement regarding our commitment to responsible investment.

Visitors to this page will find our declarations that show how our consideration of ESG factors is an integral part of our investment decision-making process. Further, we have specifically documented our beliefs in relation to the climate, modern slavery, and corporate governance.

This is not a recent decision made by us or our manager, ECP, nor is it a new way of structuring our investment portfolio. In fact, ECP was an early adopter of the United Nations-backed PRI Initiative and officially became a signatory back in 2016.

How ESG Can Deliver Strong Performance Outcomes

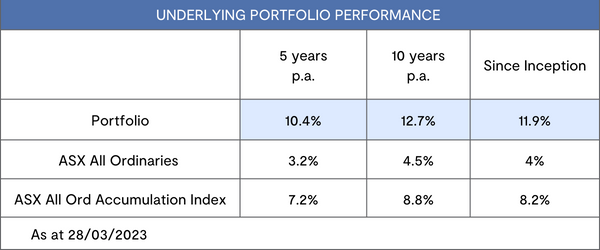

Our commitment to implementing an ESG framework has had an observably positive impact on our investment performance. The most recently released information shows that the Flagship Investments portfolio has significantly outperformed both the ASX All Ordinaries Index and the ASX Small Ordinaries Index over the last 5 years, 10 years, and since inception in 1998.

This data impeccably demonstrates that committing to the PRI Initiative and upholding those standards does not compromise the ability to maximise returns for investors but instead strengthens it.

For businesses to maintain a competitive advantage and produce sustainable growth in the global economy, their commitment to ESG practices is essential. This is why ESG is naturally and fundamentally incorporated into our investment philosophy. By investing in high-quality, responsible businesses that have the ability to generate predictable, above-average economic returns, we believe we will produce superior, long-term investment performance for our clients.

Reach Out to Our Team Today

If you’d like to learn more about our commitment to responsible investing, feel free to head over to our contact page and get in touch with a member of our team today. We’ll gladly answer any questions you may have regarding our portfolio, our practices, and how we aim to help our clients grow their wealth in the long term.