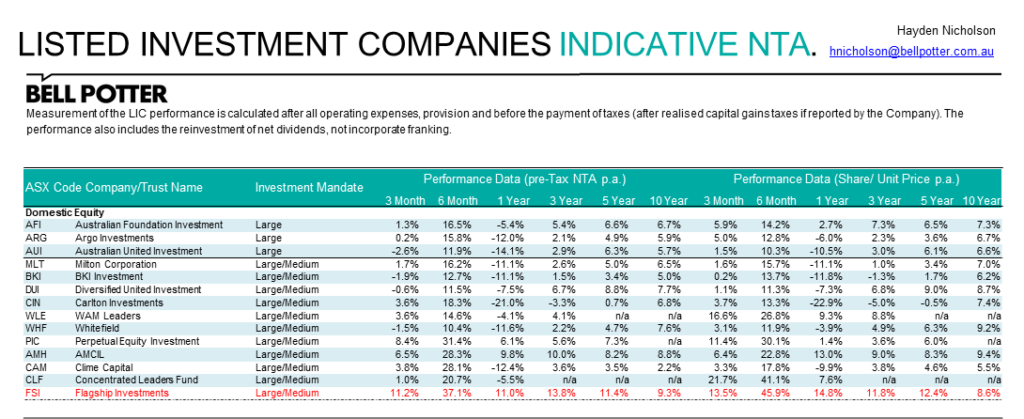

During the month we read with interest the NTA Report* which is produced by Bell Potter’s LIC/ LIT researcher Hayden Nicholson. Flagship Investments Limited (Flagship) is identified as a strong performer as per Table 1 noting LICs that invest in Large and Medium Australian companies, with Flagship’s comparative NTA and Share Price performance well above that of its peer group.

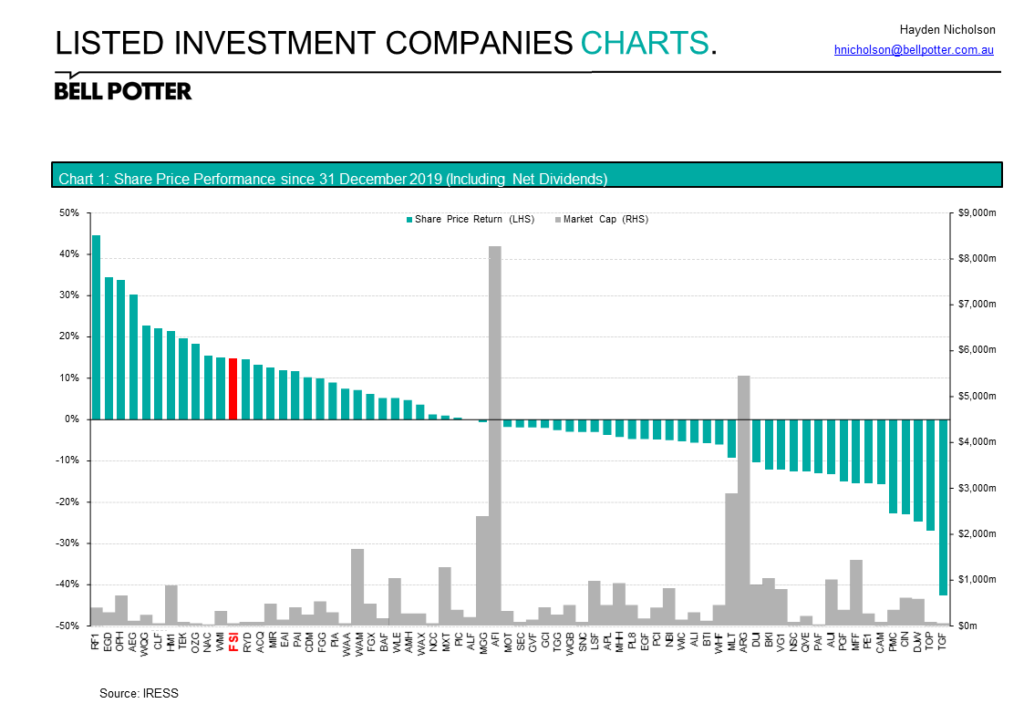

If we look into the Calendar Year 2020 Share Price Performance across those LICs and LITs covered by Bell Potter (Chart 1) we can see a positive share price return by Flagship which is highlighted in Red. In addition we can see that despite the market recovering quite strongly post-Covid19, and nearing its previous highs, many share price returns of LICs have not recovered well in 2020. Indeed many of the LICs which have generated positive share price return are international and thematic LICs.

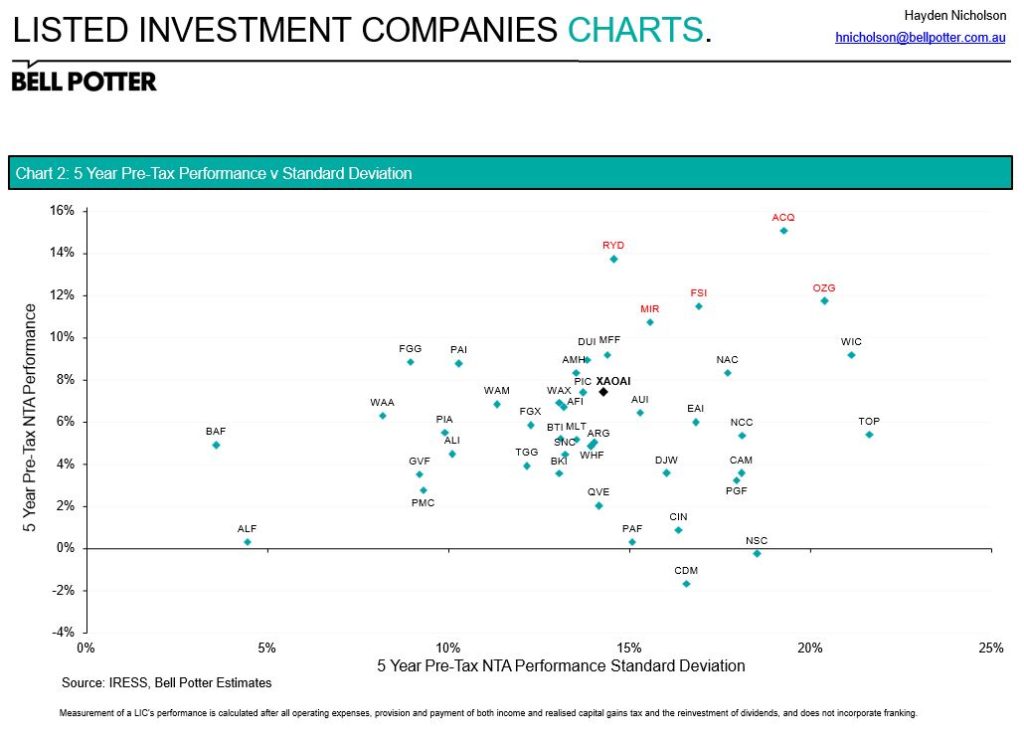

Looking deeper, and using 5 year performance (Chart 2) to see who have been strong performers over a longer time frame and using NTA not Share Price so as to identify the true driver of return we see 5 outliers that have each generated a return in excess of 10%p.a. In addition to Flagship these are ACQ (Acorn – which invests in Microcap and unlisted companies), RYD (Ryder invests in Medium and Small caps), MIR (Mirrabooka invests in Small Caps) and OZG (OzGrowth – small cap/ unlisted companies with a focus on WA based resource companies).

We can also see that most LICs have underperformed the return of the market (XAOAI – All Ordinaries Accumulated Index). Indeed Cash or Bonds may have been a better investment than most of these LICs, and would certainly have delivered less volatility along the way.

SIZE PENALTY IN LICS

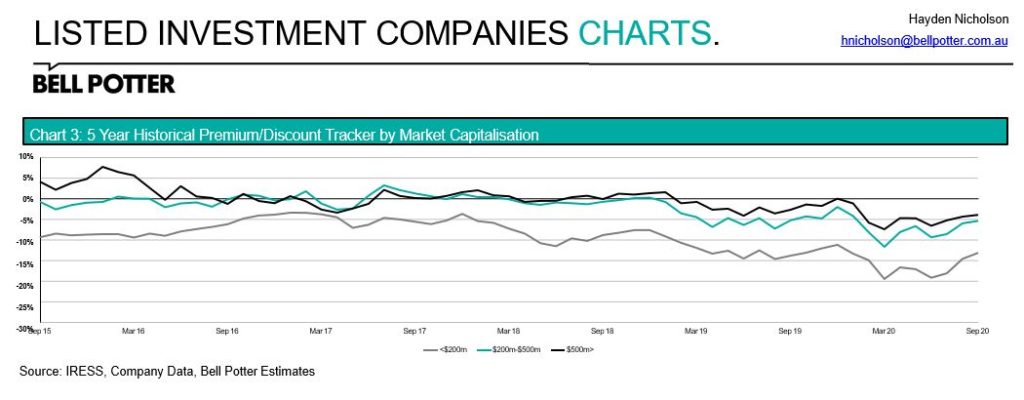

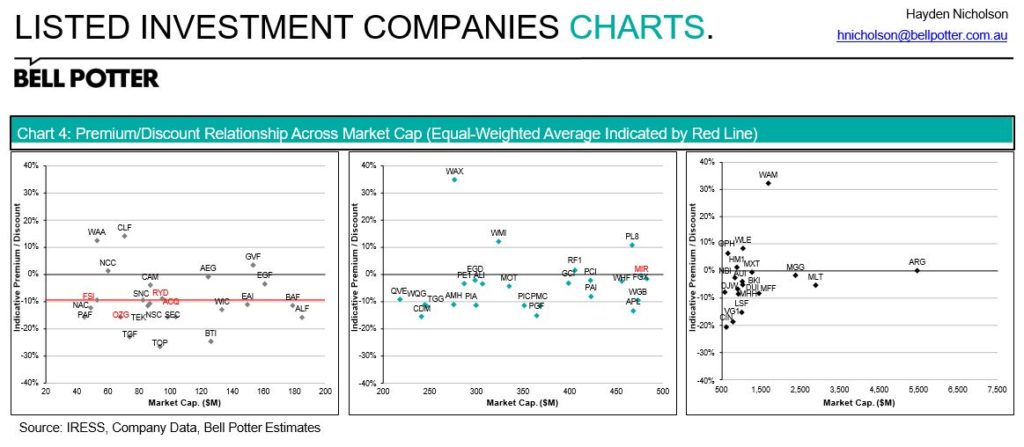

Bell Potter LIC/ LIT researcher Hayden Nicholson produces some exceptional research and regularly pulls apart LIC sector data to see if there are any observable trends or themes. One he measures is Discount to NTA. It should be noted that discounts are not a measure of the LICs NTA or Share Price performance but can identify trends and potential share price opportunities. Chart 3 identifies that collectively, discounts are clearly deeper in LICs with a smaller investment portfolio – by upward of 15% to their larger sized LIC counterparts. We can ask whether this discount penalty is deserved and is it based on performance.

While a comprehensive answer would require a full LIC by LIC analysis, Bell Potter research provides enough information to suggest a basic answer- looking at the evidence of Chart 4 it would appear that in some instances at least, there is a significant disconnect between performance and discount, which could be based on nothing more than a prejudice against smaller sized LICs.

In Chart 4 below, we again highlight those top 5 performers to see whether the market respected their top NTA performance. While past performance is no guarantee of future performance it is nonetheless a strong indicator of management competence and ability.

What is clear and perhaps counter-intuitive is that of the LICs covered by this research, the ones which generated the best 5 year NTA performance are also those amongst those with the deepest discounts.

It would appear that the market has detached itself from reality (“efficiency”) and does not look beyond portfolio size to actual performance.

At least in the instance of these smaller sized top-performing LICs this is an unfound prejudice preventing sufficient investors from paying a more realistic price to acquire future performance. And remember, they are still obtaining this at a discount, and with yield-expansion through Dividends paid on NTA.

Many LICs, such as Flagship are active in regards to promotion and awareness of their Investment Objective and Investment Performance. Flagship Investments does not rest on the laurels of strong portfolio and share price performance to extract maximum value for shareholders.

Like with Flagship’s investment portfolio performance and the direction of the lines in Bell Potter’s Chart 3, the direction of Flagship share price may be a process of “little by little…..day by day” until it finds a more suitable point that recognises its portfolio performance.

Nicholas Hayden holds the opinion that strong performing LICs should eventually be recognised by the market, irrespective of their size. He said:

“The LIC sector is virtually unrecognisable from 10 years ago and in another 10 may also be again. There are significantly more LICs, investors and investment strategies continuing to emerge. The sector is also primed with newfound opportunities following external shocks, wind-ups and market inefficiencies. In time these funds will be acknowledged for the utility and expertise they provide, with discounts on good performers continuing to narrow up. With many index hugging funds performing as expected, perhaps active managers need to be highlighted outside of discounts and portfolio size”

Time will prove when researchers are proven right in this. As all investors know, at the end of the day the only thing that matters is performance.

*Important notes to these charts: The author of this article has edited the original document through the use of the colour Red and has changed some chart numbers to assist with readability.

*Bell Potter Securities document disclaimer:

IMPORTANT DISCLAIMER – THIS MAY AFFECT YOUR LEGAL RIGHTS: Because this document has been prepared without consideration of any specific clients investment objectives, financial situation or needs, a Bell Potter Securities Limited investment adviser should be consulted before any investment decision is made. While this document is based on the information from sources which are considered reliable, Bell Potter Securities Limited, its directors, employees and consultants do not represent, warrant or guarantee, expressly or impliedly, that the information contained in this document is complete or accurate. Bell Potter Securities Limited does not accept any responsibility to inform you of any matter that subsequently comes to its notice, which may affect any of the information contained in this document. This document is a private communication to clients and is not intended for public circulation or for the use of any third party, without the prior approval of Bell Potter Securities. Disclosure of Interest: Bell Potter Securities Limited receives commission from dealing in securities and its authorised representatives, or introducers of business, may directly share in this commission. Bell Potter Securities and its associates may hold shares in the companies recommended. Bell Potter Securities Limited ABN 25 006 390 772 AFS Licence No. 243480. Data taken from 19 October Bell Potter NTA research document.