As stage one restrictions are lifted in Australia and we feel there is light at the end of the tunnel it is interesting to observe the reactions and actions taken by the investment community over the last 3 months. Trend data suggested that retail investors had become substantially more active across the securities market. This included increased trading frequency and the number of different securities traded per day, while the duration for holding securities decreased. This activity prompted ASIC to release a public warning about the risks involved.

But, investing in the stock market doesn’t have to be risky. Knowledge and experience are strong factors to mitigate the risk. We take a moment with our Manager, Manny (EC Pohl & Co), and ask – what does a long term investment manager do when there is so much volatility in the markets and uncertainty across the globe?

Has COVID-19 impacted the investment philosophy? Did the process change at all over the last 2-3 months?

As companies and countries responded to meet the health concerns of the community we conducted a thorough assessment of our investee company’s prospects in the current climate. Our investment portfolio comprises high-quality, low capital-intensive growth companies that have a sustainable competitive advantage. During the current challenge, we made sure that the competitive advantage was still relevant, that the company had sufficient capital to survive the downturn and maintained our discipline to the process.

Essentially saying that we made sure our investments still met our investment criteria, but our criteria did not change. We don’t know how long the current situation will last, but our investee companies are still in a position to provide excellent investment returns over our 3-5 year investment horizon. We are a long term manager so the fact that there is some short-term volatility does not impact the way we assess our investments.

We’ve heard that Warren Buffett is currently sitting on a large portion of cash – have you made a similar move?

Generally, our cash levels are maintained in accordance with our investment mandate, for example, with Flagship Investments Ltd the guideline target is 5% with a maximum cash holding of 20%. Some clients are very strict in holding to the limit, which means that as investment values change, we respond appropriately adjusting the portfolio in-line with the mandate. Other clients are more flexible with the limits, which means we can manage the portfolio in accordance with the internal rates of return (IRR). This means that when the IRR decreases we start to hold more cash, which did occur from December 2019 to Feb 2020.

Given that the market has broadly decreased from the highs in February, our IRR has increased significantly and many of our high-conviction investments are cheaper than at any time in recent history. This has presented a unique buying opportunity which is implemented in accordance with our model portfolio construction.

Understanding that we are not out of the woods yet are there any learnings/observations to date from the COVID-19 experience?

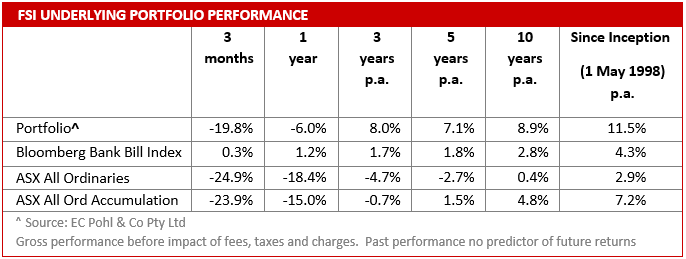

We have witnessed an incredibly unique global event which has had wide-ranging impacts on all elements of society. People are thinking about health and wellbeing as a priority, our communities, our businesses, the way we work, the way we interact, the things we value have all been disrupted in some way. And, we’re seeing individuals, communities, companies and all levels of government doing the best they can to work through this period balancing short term and long term priorities. We are incredibly grateful for the hard work of all members of society in doing their part. For our part, as the Manager of Flagship Investments Ltd and as custodians of shareholder wealth we have focused on doing our best during this challenging time and producing the best portfolio returns possible.

We have remained focused on the business fundamentals, diligently implementing our proven investment process and supporting our business partners as best we can.