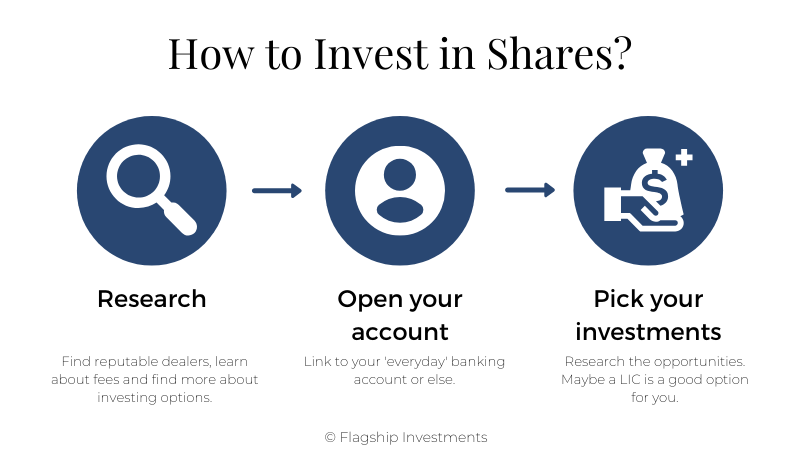

While we sit in the middle of government mandated self-isolation I have had many people e-reach out and ask how do I buy shares? This question has come from friends and family, from all levels of income, from all occupations. And at its heart it is relatively simple to answer – the more important question is what should I buy!

To buy shares is as easy as opening an online trading account. Most of the banks offer an account that can be linked to your everyday banking account and there are many businesses online that operate solely in this space. Personally, when I’m researching for the best option I test a few comparison websites like Canstar or Finder. The things you are looking for are-

- Reputable dealer – check AFSL registration details and security protocols

- Low fees – this includes brokerage, account keeping, entry and exit fees

- Ease of Use – if you can view the platform using a free trial this is a good way to test functionality, usability, reporting etc.

- Investing options – can you only invest in Australia? What about international? CFDs? indices?

If you don’t trust yourself with assessing an online platform, then a traditional stockbroker is another option. They monitor your portfolio and can buy and sell shares at your instruction. Again searching for a reputable person or organisation is paramount, a competent professional whom you can trust.